Attention: Investors, Entrepreneurs, Business Owners, & Everyday Working Americans

The Best Seller "EVERYONE ENDS UP POOR!" Can Help You Protect Your Hard-Earned Money, Retire Early, and Achieve Generational Wealth!

Up to 99% of all Americans downsize in retirement...WHY?

1

Shipping

Where To Ship Book

2

your info

Your Billing Info

Shipping

We Respect Your Privacy & Information

What is EVERYONE ENDS UP POOR!?

It is NOT just another “financial” book.

It is NOT a get-rich-quick scheme - though it will help you become rich through Compound Interest.

It is NOT a book trying to sell you a course - though it will provide you the financial knowledge to achieve the retirement you deserve!

EVERYONE ENDS UP POOR is a BLUEPRINT

This book WILL teach you why the majority of Americans downsize in retirement by using the traditional methods of the 401(k)/ Roth IRA and how to avoid that fate. YOU don't need to feel frustrated about your retirement!

This book WILL show you how to lower the fees you would pay to financial advisors by up to 90%, so more of your money is working for you. YOU don't need to pay excessive fees for underperforming results!

This book WILL teach you how to protect your hard-earned money against stock market risk, so you can sleep well knowing your retirement is secure. YOU don't need to fear losing money anymore!

This book WILL teach you the secrets of the wealthy through MPI® Premium Finance 2.0™, leveraging the power of Compound Interest and increase your retirement income by up to 200%. YOU can now access Premium Finance benefits which before now, was exclusively ONLY available to the RICH!

This book WILL provide the exact blueprint Curtis Ray uses to achieve generational wealth for his family! Now YOU can remove generational poverty from your family tree!

Hurry, This Offer Won't Last FOREVER!

"This book changes my whole financial future for me and my family! Highly recommend it!"

- Adam Rummler

"Everyone should read this! I thought it was too good to be true until I read this book!"

- Donnell Stidhum

"I did my own research and after I did, I knew I needed to share the knowledge in Everyone Ends Up Poor with everyone I could!"

- Deb Brundage

Verified Amazon Reviews

This Book Will Help YOU Learn the SECRET to Produce up to 3X More Retirement Income Over Your ROTH IRA/401K

As Seen On

From Curtis Ray

Re: How to Avoid DOWNSIZING and Live Your BEST Life in Retirement!

From Curtis Ray

Re: How To Avoid DOWNSIZING And Living Your BEST Life In Retirement!

Does This Sound Familiar?

You have a dream retirement, and you want to achieve it AS SOON as possible!

You want to retire, but may not know all the options available to you. You may have started working with a trusted friend, neighbor or family member who's in the financial advising space. You're trusting them with your future, with your retirement, with your life savings and all the money you are contributing into your ROTH IRA/401K plan. Maybe you are relying on your employer's 401K plan and contributing to it paycheck after paycheck hoping and trusting that one day you may eventually have enough saved for retirement...or at least have to work less...be able to afford to travel more...or maybe have the extra funds to invest in your own personal business, or real estate portfolio or even the next hot stock.

But the scary reality is...you don't know how much you need to save for a comfortable retirement, you may not know an age you can actually retire, or even worse you maybe doing all the right things (that you are aware of) to plan for retirement only to find out at 65 years old that you will have to live off of one-third the salary or income you were making during your working years!

How can this be? You worked day after day for almost 40 years and saved up to build a large nest egg, doing everything your trusted Financial Advisor told you too, or your employer told you to do...

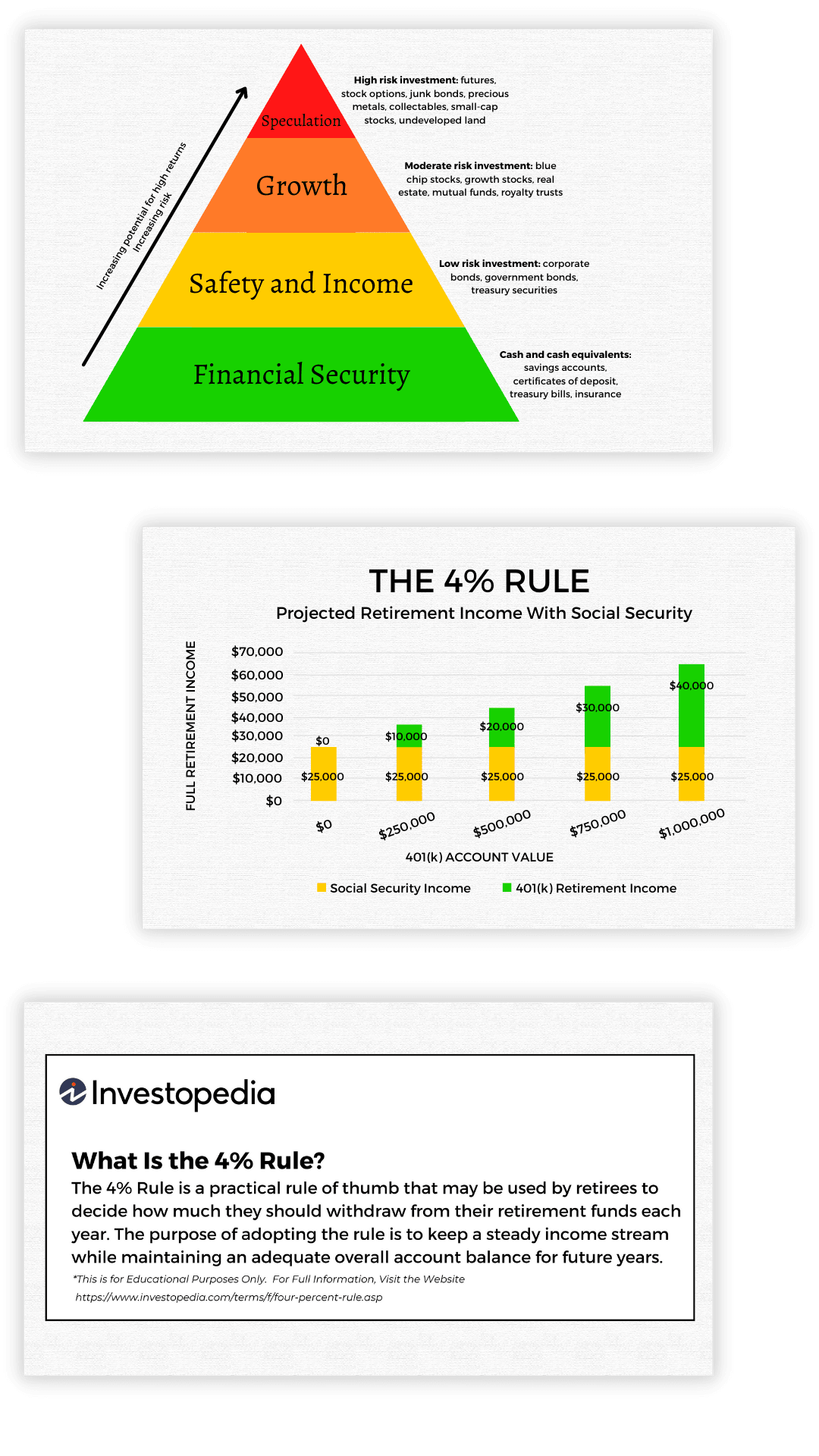

Then reality sets in...retirement nest eggs have an unspoken rule of thumb in the financial space called The 4% Rule. The 4% Rule is not talked about with your trusted financial advisor. They focus on growing your nest egg and brag about how large they can grow your nest egg, but at the same time keep from you how much you can actually live off during your retirement years!

You’re tired of seeing people like your parents, uncles, aunts and friends downsize in retirement. Move to a smaller home. Drive a used car. Being forced to get another job (during retirement) at a big box store as a "greeter" because they don't have enough income in retirement to live out their golden years! So sad...it happens everyday, literally to most retirees!

The Better Way

Your trusted financial advisor doesn't tell you that less than 2% of working Americans actually save up the elusive $1M dollars in their retirement accounts by the age of 65 years old...which is their goal. The Financial gurus talk about being the "millionaire next-door" all while not even realizing that the elusive $1M dollars produces a safe withdrawal rate of ONLY $40,000 per year in retirement income.

So do the math...if you are disciplined and able to save up $500,000 in your retirement accounts you will only be able to live on $20,000 per year!!

Are you kidding me!? How can this be? Is this real?

There has to be a BETTER way, a secure way, an accelerated way of applying Compound Interest! Good news: there is...and spoiler alert: it's in this book (that's why you NEED this ASAP).

You’ve probably heard “gurus” brag about the millions of dollars they made in the stock market. They all seem to have an “I made a million dollars and look how cool I am” story. But no one teaches you how to KEEP money and SECURELY accelerate money. That's where this book comes into play...

Maybe your dream retirement is to build a business, build a real estate portfolio, spend more time with kids, travel the world, spend time doing recreational activities like camping, fishing, golfing, hiking, etc. Well wouldn't you RATHER do that BEFORE you turn 65 years old? Wouldn't you rather do those activities in your 50's or 40's or possibly even earlier?

The reality is you can! I did...and now it's my mission to share it with the WORLD!

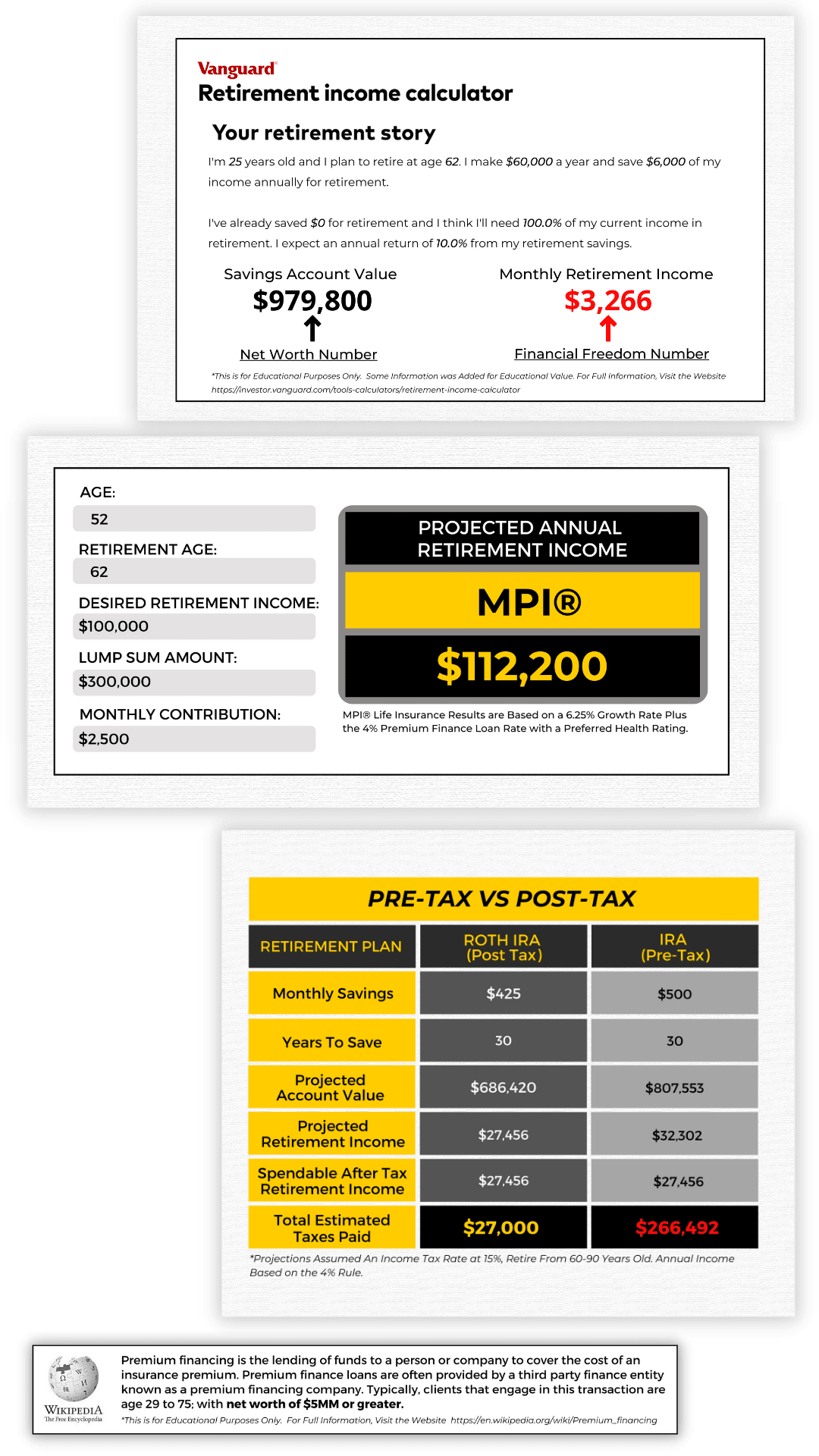

Secure Compound Interest Accounts

By reading this book you will learn exactly where I put my money, and how I was able to retire by the age of 40 years old producing over $500,000 per year in tax-free income for the rest of my life, through my Secure Compound Interest Accounts. Now I am able to do what I want, when I want, with whom I want! True financial freedom...something traditional and outdated strategies would NEVER provide!

Whichever level of income you want to achieve, it’s a possibility with the power of Secure Compound Interest, that is why Albert Einstein is known to have said, "Compound Interest is the 8th wonder of the world...the most powerful force in the universe".

I want to teach you, show you, qualify you and help you apply the same Compound Interest force to your income now and in retirement!

You might be frustrated thinking, why has no one ever taught me this before? Why doesn't my trusted financial advisor show me how to apply Secure Compound Interest, but the truth is innovation takes time for the market to accept and adopt! And this strategy I use, was not around until I designed it, patented it, and now have legal permission from A+ Rated Life Insurance companies to offer it to everyday working Americans!

Let me tell you a little backstory that got me to the point of making over a half a million dollars a year tax-free inside my Secure Compound Interest Accounts. It doesn't happen overnight, but with discipline and dedication you can achieve a retirement that is secure and fruitful.

Investment vs. Retirement

Look, I get it...this might be a surprise to you and maybe even a little frustrating. You need to remember that none of this is your fault. It's an industry flaw that I, along with my team of Certified Advisors, are on a mission to fix! (You can see some of their photos below).

Let me explain a little more about what I mean when I said the financial industry has it all backwards...

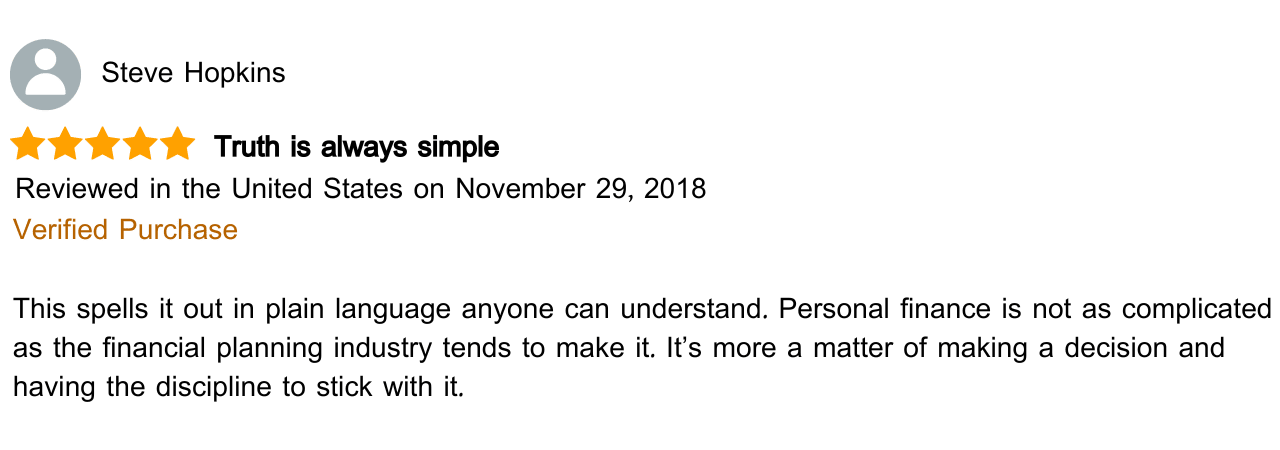

For example, if you were to "save for retirement" inside a ROTH IRA/401K with a financial advisor for your entire working career until retirement, your money is usually fully exposed to market risk. Financial Advisors are so focused on growing your nest egg size (making it an investment account) but not usually without the risk of the market. At the same time, your money is growing inside these investment accounts (or losing like in 2008, dotcom bubble and more recently in 2022) it has exposure to stock market loss.

And as you near retirement age, Financial Advisors are trained to invest your life savings into less risky and more secure strategies, and only withdrawal a safe withdrawal rate of 4% (as mentioned earlier). Let me be clear, ROTH IRA/401K were never designed to produce retirement income. There focus is growing the size of your nest egg! You may have heard your Financial Advisors say, "don't worry it will bounce back" ignoring the fact the time that was lost in these recession was valuable Compound Interest growth time that can never be bought back. The retirement strategy I built MPI® (Maximum Premium Indexing) has an advance built in feature of the 0% Floor protects your money and a match program to accelerate the growth (which my books will teach your more about).

We want our clients, and everyone for that matter, to live their best life, especially in retirement! You work hard for your money, and I believe you should have right to find financial freedom and be able to RETIRE when YOU WANT with the amount of income you want for your best life! That is why my mission and all the partners I have brought on board are doing everything we can to educate the market.

Look, I get it... This might be a surprise to you and maybe even a little frustrating. You need to remember that none of this is your fault. It's an industry flaw that my team and I of Certified Advisors all over the country are on a mission to fix!

We want everyone to live their best life, especially in retirement, and have the freedom to choose when they retire and with the amount of income they want!

Let me explain a little more about what I mean when I say industry flaw. For example, if you were to work with a financial advisor for your entire working career until retirement, they actually risk retirement income by investing into high return stocks, but at the same time are fully exposing your money to stock market risk. And as you near retirement age, they get less risky and secure but ending up producing smaller amounts of income for retirement. They always say, "don't worry it will bounce back" ignoring the fact the time lost to bounce back and not realizing something like MPI® protects your money, so you never lose with the 0% Floor protection (which my books teach about).

My Financial Journey

While attending Arizona State University, competing on the wrestling team, I started my first business in the granite countertop industry. We grew from a basement startup to servicing over 60 kitchens a week by the year 2012.

I was in my twenties making hundreds of thousands of dollars a year, and like most entrepreneurs, continued to invest in the expansion of my business, never applying the foundational concepts I know now. Never SECURING my hard-earned money from loss or risk.

Then financial Armageddon happened. In 2014, the business I had been building for almost 10 years was lost overnight due to a partnership dispute (that I won't get into here, watch my documentary to hear more about that).

Home Show During The Granite Years

The Ray Family Photo in 2020

Here I was, married with five children (see the family to the left) and that thing I had given my whole working career to was gone! I was very distraught. The next day I thought, I built it once, I can build it again! And went back to work...

Now looking back, that was the best day of my life. That short term loss put me on the path to discover MPI® (Maximum Premium Indexing). My drive was clear, I wanted to become obsessed with protecting my money and never being vulnerable with money again!

I was determined to understand all the different services and products that are offered in today's financial market. What I found is a lot of the current policies and strategies offered some of the features and benefits I desired, but none of them were an all-in-one solution. So, like many other businesses before, I created my own product!

Here I was, married with five children (see the family to the left) and that thing I had given my whole working career to was gone! I was very distraught. Then next day I thought, I built it once, I can build it again! And went back to work...

Now looking back, that was signal handedly the best day of my life. That short term loss put me on the path to discover, what today is known as MPI® (Maximum Premium Indexing). My drive was clear, I wanted to become obsessed with protecting my money and never being vulnerable with money again!

I became obsessed to understand all the different services and products that are offered in today's financial market. What I found is a lot of the current policies and strategies offered features and benefits I liked, but overall lacking the all-in-one solution. So, like many other businesses before, I created my own product!

The Ray Family Photo In 2020

I went to work to understand all the different services and products that are offered in today's market. What I found is a lot of the current policies and strategies offered features and benefits I wanted to apply to my finances, but they all lacked the all-in-one solution. So, like many other industry solutions I developed my own, with the mindset to protect my, my money and my future generations.

Invitation & Mission

Now here we are, several years into our mission educating clients on applying Secure Compound Interest and taking advantage of all the features and benefits MPI® has to offer.

I licensed the permission and fully vetted and hired MPI® Certified Advisors all over the country who have seen the vision and joining the movement!

The momentum is undeniable (see the pictures of these MPI® Certified Advisors below) the people are in place, the product is in place, and the processes are in place.

MPI® Strategy is taking the industry by storm with the mission to allow everyone the ability to apply and qualify to the advance strategy known as MPI®, that offers the features and benefits listed below...

With MPI® You Can Retire at ANY Age!

Retire Early! No more age restrictions on retirement. Decide what age you want to retire and be disciplined and dedicated and you can accomplish it!

Create Generational Wealth! Leave a legacy of income and secure compounding accounts for your children and grandchildren, the REAL American dream.

Increased Retirement Income! Apply the innovation inside of the MPI® Strategy and you could end up living on 200% more tax-free income, than a traditional ROTH IRA/401K.

Protect Your Money! Protect your hard-earned money from stock market risk, but at the same time, accelerate your wealth with stock market growth.

Lowest Expenses! Cut out traditional middle-men who take a percentage of your life savings.

And much much more...

The bottom line: you need to decide for yourself if this is right for you! I am not here trying to sell you anything. I am here to motivate you to educate yourself. That's why getting my FREE book is a great first step in your financial journey. Do your research, fact check everything I say, and you may also come to realize what thousands of my clients have: the MPI® Strategy is the key to achieving a dream retirement!

Some might say, sounds too good to be true...I know, most people do when they first hear about it. And that's okay, but I practice what I preach. 100% fully committed and I save $1.5M dollars a year into my Secure Compound Interest Accounts, because I have done years and years of research. Have you ever asked your financial advisor where they put their money?

Spend time with me or one of my licensed MPI® Certified Advisors. Let them customize a plan, give you a clear road map to your future! It's entirely FREE of charge. They will take time to understand your situation, your hopes, your dreams, your fears and your future retirement. Spend time with them on the MPI® Secure Compound Interest Account Calculator. This is a great resource for you to see exactly how much you need to save and at what age you can retire!

Abraham Lincoln is known to have said, "The best way to predict the future is to create it" and that is exactly what the MPI® Strategy and EVERYONE ENDS UP POOR! can help you do! So give yourself permission today and take the next step!

Always Be Compounding,

Some might say, sounds too good to be true...I know, most people do when they first hear about it. And that's okay, but I practice what I preach. 100% fully committed and I save $1.5M dollars a year into my Secure Compound Interest Accounts, because I have done years and years of research. Have you ever asked your financial advisor where they put their money?

Spend time with me or one of my licensed MPI® Certified Advisors. Let them customize a plan, give you a clear road map to your future! It's entirely FREE of charge. They will take time to understand your situation, your hopes, your dreams, your fears and your future retirement. Spend time with them on the MPI® Secure Compound Interest Account Calculator. This is a great resource for you to see exactly how much you need to save and at what age you can retire!

Abraham Lincoln is known to have said, "The best way to predict the future is to create it" and that is exactly what the MPI® Strategy and EVERYONE ENDS UP POOR! can help you do! So give yourself permission today and take the next step!

Always Be Compounding,

Follow Curtis Ray On

Our Recent Event

Here are Just a FEW of My MPI® Certified Advisors

Our Recent Event

Here Are Just A FEW Of My MPI® Certified Advisors!

"You Do NOT Want to Sleep On This One!"

I’m absolutely thrilled to finally have my own copy to always refer back to as my “financial bible” and ultimate key to success. I feel blessed to have come across Curtis and his knowledge. This book is an easy read and will literally change your perspective and improve your life. I’m grateful and feel both prepared and excited for the future knowing what I know now, having read this book. You do not want to sleep on this one! - Brie

Claim Your Copy of

Claim Your Copy of

"Everybody should read this book! It’s life changing and Curtis is right when he says live off 90% of your earnings. You won’t even notice it’s gone. My only complaint is, I Just wish I would’ve started sooner." - Greg

Here is What YOU Can Expect When You Read Your FREE Copy

How to KEEP your money (anyone can teach you how to make money).

What the Financial Advisors don't tell you (until its too late).

Why retirement planning is backwards (and how to fix this)

The Three D's of financial insecurity (I'll teach you to protect yourself against these).

How to LEVERAGE your money (the way you protect your most prized possessions).

And much, MUCH more!

You will have reflections at the end of each chapter, this will allow you to really take the steps needed for true financial success.

There's no fluff. There's no assumptions. This is all backed by REAL math!

There's no fluff. There's no assumptions. This is all backed by REAL math!

"Great book with tons of research behind it. Obviously someone who knows what they are talking about." - Emily

Here is a Peek Inside Your FREE Book

Chapter 1: Everyone Ends Up Poor™

Chapter 2: How the Traditional System Works (And Doesn’t)

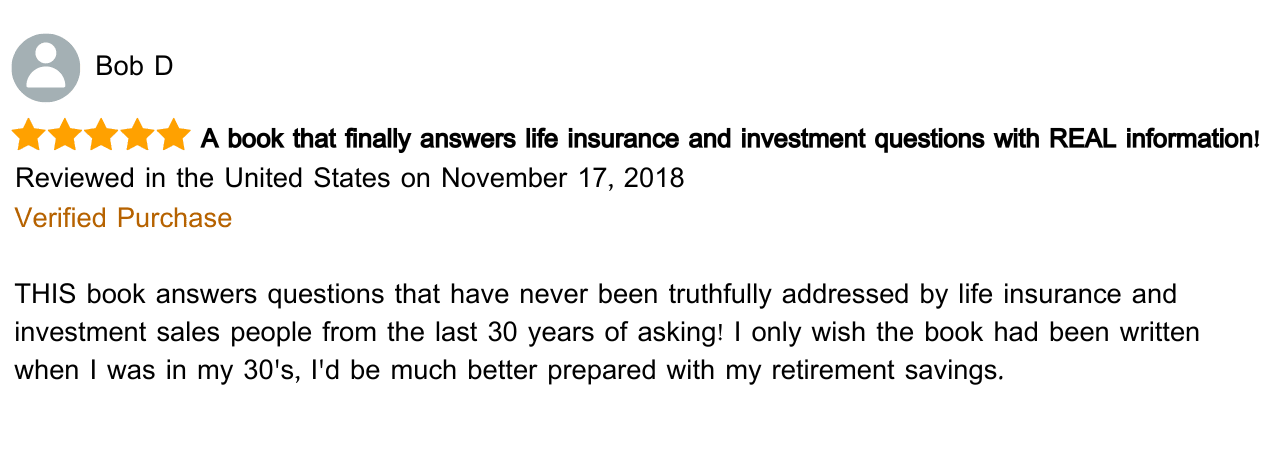

Chapter 3: Income Killers: The Risk Pyramid and 4% Rule

Chapter 4: What Your Planner Doesn’t Tell You WILL Hurt You

Chapter 5: The Downsizing Myth

Chapter 6: The Female Poverty Crisis

Chapter 7: The Rules of Money

Chapter 8: Never Trust Business

Chapter 9: The Evolution of Money

Chapter 10: Financial Discovery

Chapter 11: Compound Interest: The Magic of Money Making Money

Chapter 12: The 0% Floor— The Ultimate Feature

Chapter 13: Secure Leverage: Compounding the Compound

Chapter 14: MPI® 12 Pillars

Chapter 15: Financial Freedom: The Holy Grail

Here are some quotes from

Throughout this book I am going to expose many hidden truths about the retirement planning industry (and how its stacked against you from the beginning). -pg. 3

Hard-working people should have the opportunity to deploy a retirement plan that produces the maximum amount of retirement income, eliminating the requirement to downsize your lifestyle. -pg. 4

I will show you how to avoid the fate of so many other Americans who are driven to a stress-filled retirement by our traditional financial system. -pg. 6

I want you to throw out the idea that you don't have enough money to start a retirement plan today, and I want you to begin planning for your tomorrow with precision and enthusiasm. -pg. 6

This book will demonstrate a revolutionary way for you to live the life you want: the life of your own design. -pg. 7

What if I told you everything you thought you knew about the current retirement industry is outdated or completely wrong? -pg. 9

This brief summary simply scratches the surface of why the

traditional retirement plans were never designed in your best interest. -pg.11

Questioning

common thought is how progress and innovation occur. -pg. 11

The risk pyramid theory of retirement planning is the enemy of retirement all retirement income. -pg. 14

The problem with those who practice this traditional theory of financial planning is that they believe account value is king. It is not! -pg. 15

Retirement plans that are based on the risk pyramid theory can never produce a great retirement income, at least not securely. It's mathematically impossible. -pg. 16

Advisors don't want to explain why the 401(k) and IRA don't produce sufficient retirement income or true financial freedom. - pg. 19

Because their (financial advisors) paycheck is not affected by your retirement income success, there is no incentive to make that a priority. -pg. 21

No one should ever be fooled into deferring their tax if possible. -pg. 22

Someone with eight years at Vanguard, a high salary, bonuses, and a competitive benefits package, saw the truth of the broken financial sector and was willing to join my efforts in educating the world on how to achieve true financial freedom. -pg. 24

The financial awakening is happening as we speak, and it is exciting. -pg. 25

The financial world has somehow convinced society that downsizing in retirement is acceptable and is the best possible outcome. -pg. 27

Until spendable income becomes the focus of a retirement plan, downsizing will always be the norm. -pg. 28

My credentials are that I live by the ultimate fiduciary standard in that I provide people with exactly what I do with my own money. -pg. 31

I am incentivized to help you because it makes me happy. -pg.32

After much research, it is my professional opinion that financial security is initially a matter of individual focus. -pg. 34

Only good can come from retirement planning. Financial education and understanding how to achieve financial security will only strengthen the individual while improving the marriage between two people seeking the same goals. -pg. 37

And That's JUST The First 37 Pages...

Here are some of our Readers' thoughts...

- Alex Alanso

- Amy White

- Carolyn Blosil

- Deenise Luu

- Jay Groman

And that's JUST the first 37 Pages...

"I would highly recommend this book. Quick read and great information! Matter of fact I'm giving this book as Christmas gifts!" - Ronda

In Case You Need a Few More Testimonials...

- John Skabelund

- Scott McLaine

- John Turner

- Ryan Richardson

- Victor James

- LJ Crandell

"IF YOU'RE BORN POOR, IT'S NOT YOUR FAULT. IF YOU DIE POOR, IT'S

100% YOUR FAULT!"

- Curtis Ray

- Curtis Ray

459 N Gilbert Road Suite B-200

Gilbert, AZ 85234

480-530-5840contact@compoundinterest.com